Term Life Insurance Quotes for High Income Earners lays the foundation for an in-depth exploration of this crucial financial topic. As we delve into the intricacies of term life insurance, high-income earners will gain valuable insights into securing their financial future with the right coverage.

Exploring the various factors, customization options, and shopping strategies, this guide aims to equip readers with the knowledge needed to make informed decisions about their insurance needs.

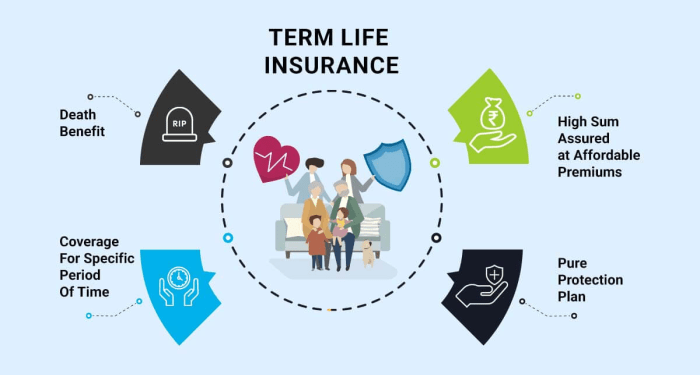

Understanding Term Life Insurance

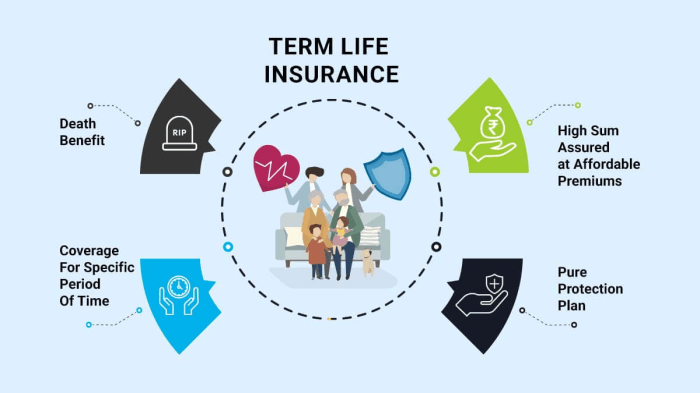

Term life insurance is a type of life insurance that provides coverage for a specified period, known as the term. It is designed to provide financial protection for your loved ones in the event of your death during the term of the policy.

Term life insurance differs from other types of life insurance, such as whole life or universal life insurance, in that it does not build cash value over time. Instead, it offers pure death benefit protection for a set period, typically ranging from 10 to 30 years.

Benefits of Term Life Insurance for High-Income Earners

- Cost-effective coverage: Term life insurance tends to be more affordable than other types of life insurance, making it an attractive option for high-income earners who want to maximize their coverage.

- Flexibility: High-income earners often have changing financial needs and circumstances. Term life insurance allows them to adjust their coverage amount and term length to suit their current situation.

- Income replacement: In the unfortunate event of a high-income earner's death, term life insurance can provide a tax-free lump sum payment to replace lost income and support their family's financial security.

- Estate planning: Term life insurance can be a valuable tool for high-income earners looking to protect their estate and ensure a smooth transfer of wealth to their heirs.

Factors to Consider for High-Income Earners

When it comes to choosing term life insurance, high-income earners have specific factors to consider that differ from those with lower incomes. Understanding these factors is crucial in making an informed decision to protect their loved ones financially.

Importance of Coverage Amount and Term Length

Determining the right coverage amount and term length is essential for high-income earners. The coverage amount should be sufficient to replace their income and cover any outstanding debts or expenses. High-income earners may need a higher coverage amount to maintain their family's lifestyle and financial security.

Additionally, the term length should align with their financial responsibilities and future plans. Longer terms may be necessary to protect their loved ones until retirement or until their children are financially independent.

- Consider a coverage amount that is at least 10-15 times your annual income to ensure adequate protection.

- Choose a term length that matches the duration of your financial obligations, such as mortgage payments, children's education, or retirement savings.

- Reevaluate your coverage amount and term length periodically to adjust for any changes in income, expenses, or financial goals.

Impact of Age and Health Status on Term Life Insurance Quotes

Age and health status play a significant role in determining term life insurance quotes for high-income earners. Younger individuals and those in good health generally receive lower premiums due to a lower risk of mortality. High-income earners who are older or have pre-existing health conditions may face higher premiums or limitations in coverage.

It is important for high-income earners to undergo regular health check-ups and maintain a healthy lifestyle to potentially lower their insurance premiums.

- Younger high-income earners may benefit from locking in lower premiums by purchasing term life insurance at a younger age.

- High-income earners with health issues should explore options such as guaranteed issue or simplified issue policies that do not require a medical exam.

- Consulting with an insurance agent or financial advisor can help high-income earners navigate the impact of age and health status on their term life insurance quotes.

Customization Options for High-Income Earners

When it comes to selecting term life insurance, high-income earners have a variety of customization options available to tailor their policy to meet their specific needs and lifestyle.

Riders for Additional Coverage

Adding riders to a term life insurance policy can provide high-income earners with additional coverage beyond the basic death benefit. Here are some common riders that can be considered:

- Accelerated Death Benefit Rider: Allows the policyholder to access a portion of the death benefit if diagnosed with a terminal illness.

- Waiver of Premium Rider: Waives premium payments if the policyholder becomes disabled and is unable to work.

- Child Term Rider: Provides coverage for the policyholder's children for a specified term.

Tailoring Policy to Specific Needs

High-income earners can customize their term life insurance policy to align with their specific needs by:

- Choosing the appropriate coverage amount based on income, lifestyle, and financial obligations.

- Selecting a term length that corresponds with financial goals, such as mortgage payoff or college tuition for children.

- Considering additional riders to enhance coverage and protect against unforeseen circumstances.

Shopping for Term Life Insurance Quotes

When it comes to shopping for term life insurance quotes, high-income earners have specific needs and considerations to keep in mind. It's essential to approach the process strategically to ensure you get the right coverage at the best possible price.

Comparing Quotes from Different Providers

- Start by gathering quotes from multiple insurance providers to compare prices and coverage options.

- Look beyond the premium cost and consider factors such as the insurer's reputation, financial stability, and customer service.

- Pay attention to the policy details, including the coverage term, death benefit amount, and any additional riders or benefits included.

- Use online comparison tools or work with an independent insurance agent to streamline the quote comparison process.

Consulting with a Financial Advisor or Insurance Agent

- Seeking guidance from a financial advisor or insurance agent can help you navigate the complexities of term life insurance.

- An expert can assess your financial situation, lifestyle, and insurance needs to recommend the most suitable coverage amount and policy features.

- They can also provide insights on the best insurance providers in the market and help you tailor a policy that aligns with your long-term financial goals.

- Don't hesitate to ask questions and clarify any doubts you may have during the consultation process.

Concluding Remarks

In conclusion, Term Life Insurance Quotes for High Income Earners sheds light on the complexities of choosing the right policy for individuals with substantial incomes. By understanding the nuances of term life insurance and how it can be tailored to specific needs, high-income earners can protect their loved ones and assets effectively.

Expert Answers

What is term life insurance?

Term life insurance provides coverage for a specific period and pays out a death benefit to beneficiaries if the insured passes away during the term.

How does term life insurance differ from other types of life insurance?

Term life insurance offers coverage for a set period, unlike whole life insurance, which provides coverage for the insured's entire life and includes a cash value component.

What factors should high-income earners consider when choosing term life insurance?

High-income earners should consider coverage amount, term length based on income level, age, and health status when selecting term life insurance.

What customization options are available for high-income earners with term life insurance?

High-income earners can customize their policies with riders for additional coverage and tailor their coverage to meet specific needs and lifestyle.

How can high-income earners shop for term life insurance quotes effectively?

High-income earners can shop for quotes by comparing coverage options from different providers and consulting with financial advisors or insurance agents for guidance.