As we delve into the realm of Home and Auto Insurance: One Policy or Separate Coverage, a fascinating journey unfolds, offering insights into the intricacies of insurance choices. This exploration promises to be informative and thought-provoking, shedding light on the nuances of bundling policies and the considerations that come into play when making such decisions.

The subsequent paragraph will delve deeper into the specifics of this crucial topic, providing clarity and depth to aid in decision-making.

Pros and Cons of Bundling Home and Auto Insurance

When it comes to insurance, bundling your home and auto policies can have both advantages and disadvantages. Let's explore the pros and cons of combining these coverages.

Advantages of Bundling

- Bundling home and auto insurance can lead to cost savings. Insurance companies often offer discounts for customers who purchase multiple policies from them.

- Managing one policy for both home and auto insurance can be more convenient than dealing with separate policies from different providers.

- With a bundled policy, you may have a single deductible for both home and auto claims, which can result in savings in the event of a covered loss.

Disadvantages of Bundling

- While bundling can save you money, it's important to compare the cost of a bundled policy with the cost of separate policies to ensure you're getting the best deal.

- If you're not happy with one aspect of your insurance coverage, such as your auto policy, you may be stuck with the entire bundled package until it's up for renewal.

- In some cases, bundling might limit your ability to customize your coverage to fit your specific needs for each type of insurance.

Factors to Consider When Deciding Between One Policy or Separate Coverage

When deciding between one policy or separate coverage for home and auto insurance, there are several key factors that individuals should consider to make an informed decision.Some of the factors to consider include the type of home and vehicle you own.

The value, age, and condition of your home and vehicle can impact the type of coverage needed and whether bundling them together or having separate policies would be more cost-effective.Another important factor to consider is your personal circumstances, such as your location and driving habits.

Living in an area prone to natural disasters or high crime rates may require additional coverage for your home or vehicle. Similarly, if you have a long commute or a history of accidents, you may need more comprehensive auto insurance coverage.

Impact of Home Type on Insurance Decision

The type of home you own can greatly impact your insurance decision. For example, if you own a high-value home with unique features, you may need specialized coverage that is best obtained through a separate policy. On the other hand, if you have a standard home with typical risks, bundling home and auto insurance could save you money.

Effect of Vehicle Type on Insurance Decision

Similarly, the type of vehicle you own can influence your insurance decision. Luxury cars, classic cars, or vehicles with expensive modifications may require separate coverage to ensure adequate protection. On the contrary, if you have a standard vehicle with no special features, bundling your auto insurance with your home insurance could be a cost-effective option.

Role of Personal Circumstances in Decision Making

Personal circumstances such as your location and driving habits play a significant role in determining whether to opt for one policy or separate coverage. For instance, if you live in a high-crime area or regularly park your car on the street, you may need additional coverage that is best obtained through separate policies.

On the other hand, if you have a safe driving record and live in a low-risk area, bundling your insurance could result in savings.

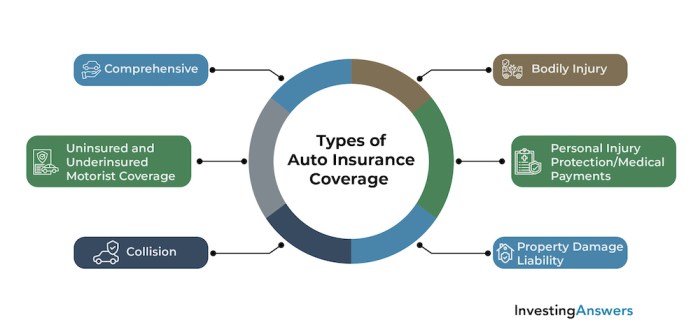

Coverage Options

When it comes to choosing between a combined home and auto insurance policy or separate policies, understanding the differences in coverage options is crucial. Each option offers distinct advantages and disadvantages that can impact your overall financial protection.

Differences in Coverage Options

- A combined policy typically offers a bundled discount, providing cost savings compared to purchasing separate policies.

- Separate policies allow for customization of coverage limits and deductibles for each type of insurance, providing more tailored protection.

Scenarios for Choosing One Type of Coverage

- If you have multiple vehicles or properties, separate policies may be beneficial as they allow you to adjust coverage individually based on specific needs.

- For individuals looking for simplicity and potential cost savings, a combined policy could be the better choice.

Flexibility of Coverage Adjustments

- Combined policies may offer less flexibility in adjusting coverage levels as changes to one policy could impact the other.

- Separate policies provide more control over adjustments, allowing you to modify coverage independently for your home and auto insurance.

Insurance Premiums

Pricing is a crucial factor when deciding between a bundled home and auto insurance policy or separate coverage. Let's delve into the cost implications and potential savings opportunities.

Cost Comparison Between Bundled and Separate Policies

- When bundling home and auto insurance, insurance companies typically offer discounts on the overall premium. This can result in lower annual costs compared to purchasing separate policies.

- Separate policies may offer more flexibility in choosing coverage options tailored to specific needs but could end up being costlier in total premiums.

Tips to Save Money on Premiums

- Review and compare quotes from multiple insurance providers to ensure you're getting the best deal.

- Consider raising deductibles to lower premium costs, but make sure you can afford the out-of-pocket expenses in case of a claim.

- Ask about available discounts such as bundling, safe driving, home security features, or loyalty programs.

Hidden Costs Associated with Bundled or Separate Policies

- While bundling may seem like a cost-effective option, some hidden fees or charges could apply. Make sure to read the fine print and understand all the terms and conditions of the policy.

- Separate policies might involve additional administrative fees or processing charges, so it's essential to factor in these extra costs when making a decision.

End of Discussion

In conclusion, the discourse surrounding Home and Auto Insurance: One Policy or Separate Coverage encapsulates the essence of balancing convenience and cost-effectiveness. By weighing the pros and cons, individuals can make informed choices that align with their unique circumstances.

Clarifying Questions

What are the advantages of bundling home and auto insurance?

Combining policies can often lead to discounts and simplified management.

How do personal circumstances influence the decision between one policy or separate coverage?

Factors like location and driving habits can impact the choice of insurance setup.

Are there hidden costs associated with bundled or separate policies?

It's essential to carefully review all terms to uncover any potential hidden costs.