Embark on a journey through the realm of Cheap Full Coverage Insurance Options for New Drivers. This guide aims to provide valuable insights and practical advice to help new drivers navigate the complex world of insurance with ease.

In the following sections, we will delve into key aspects such as factors influencing insurance costs, strategies to find affordable coverage, and special considerations for new drivers seeking full coverage.

Overview of Cheap Full Coverage Insurance for New Drivers

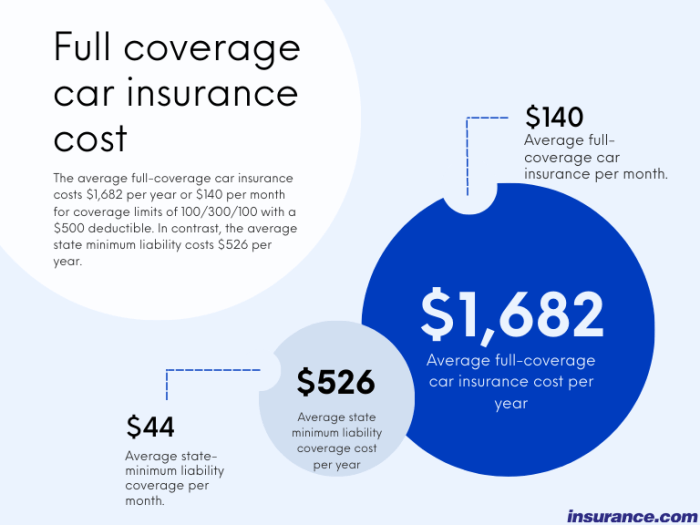

Full coverage insurance typically includes liability coverage, collision coverage, and comprehensive coverage. It offers more extensive protection than basic liability insurance.

New drivers may need full coverage insurance because they are more likely to be involved in accidents due to their lack of experience on the road. Full coverage can help cover the costs of vehicle repairs or medical expenses in case of an accident.

It is important for new drivers to find affordable full coverage insurance options to ensure they are adequately protected without breaking the bank. By comparing quotes from different insurance companies and taking advantage of discounts, new drivers can find cost-effective options that meet their needs.

Factors Influencing Insurance Costs for New Drivers

Insurance costs for new drivers are influenced by various factors that insurers take into consideration when calculating premiums. Understanding these factors can help new drivers make informed decisions when choosing an insurance policy.

Age and Driving Experience

Younger drivers and those with limited driving experience are often considered high-risk by insurance companies, leading to higher insurance premiums. This is because statistics show that younger and less experienced drivers are more likely to be involved in accidents.

Type of Vehicle

The type of vehicle a new driver chooses to insure can significantly impact insurance premiums. Sports cars and luxury vehicles typically have higher insurance rates due to their higher repair costs and greater likelihood of theft.

Location

Where a new driver lives can also affect insurance costs. Urban areas with higher traffic congestion and crime rates tend to have higher insurance premiums compared to rural areas. Additionally, areas prone to severe weather conditions may also result in higher premiums.

Driving Record

A new driver's driving record plays a crucial role in determining insurance prices. Drivers with a history of accidents or traffic violations are considered higher risk and will likely face increased insurance rates. On the other hand, a clean driving record can lead to lower premiums as it demonstrates responsible and safe driving habits.

Strategies to Find Affordable Full Coverage Insurance

Finding affordable full coverage insurance for new drivers can seem like a daunting task, but with the right strategies, it is possible to lower your overall costs. Here are some tips to help you navigate the process and find the best insurance option for your needs.

Comparing Quotes from Different Insurance Companies

- Obtain quotes from multiple insurance companies to compare prices and coverage options.

- Consider using online comparison tools to streamline the process and find the best deal.

- Look for customer reviews and ratings to gauge the quality of service provided by each insurance company.

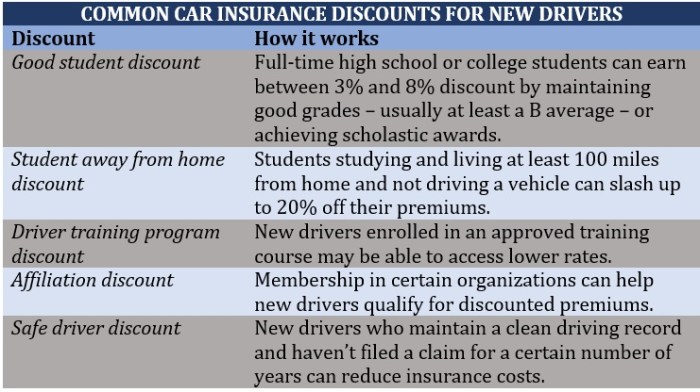

Discounts Available for New Drivers

- Ask about available discounts for new drivers, such as good student discounts or safe driving discounts.

- Consider enrolling in a defensive driving course to potentially qualify for additional discounts.

- Explore options for low mileage discounts if you do not drive frequently.

Benefits of Bundling Policies

- Consider bundling your auto insurance policy with other insurance policies, such as homeowners or renters insurance, to receive a multi-policy discount.

- Discuss bundling options with your insurance provider to see how much you can save by combining policies.

- Review the coverage details and ensure that bundling policies does not compromise the level of coverage you need.

Special Considerations for New Drivers Seeking Full Coverage

Understanding the intricacies of full coverage insurance is crucial for new drivers to make informed decisions that suit their needs and budget. Here are some special considerations to keep in mind:

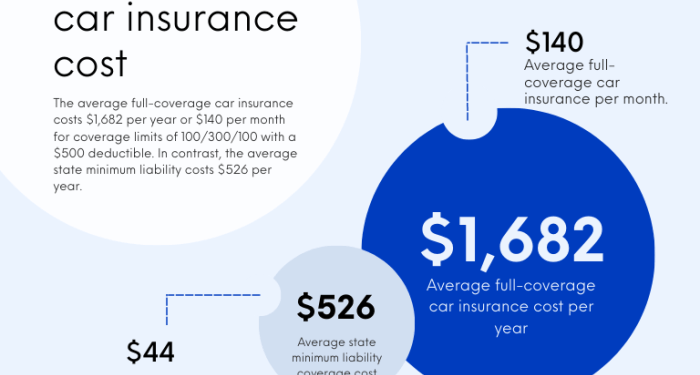

Policy Limits and Deductibles

- Policy limits refer to the maximum amount an insurance company will pay out for a covered claim. New drivers should carefully evaluate their financial situation and driving habits to determine appropriate policy limits.

- Deductibles are the out-of-pocket amount a driver must pay before their insurance coverage kicks in. Choosing a higher deductible can lower monthly premiums, but new drivers should ensure they can afford the deductible in case of an accident.

Actual Cash Value vs. Agreed Value Policies

- Actual cash value policies reimburse drivers for the current market value of their vehicle at the time of a claim. On the other hand, agreed value policies allow drivers to set a specific value for their vehicle upfront, providing more certainty in case of a total loss.

- New drivers should consider their vehicle's depreciation rate and overall value to decide which type of policy best suits their needs.

Significance of Comprehensive Coverage

- Comprehensive coverage protects drivers against non-collision incidents such as theft, vandalism, and natural disasters. For new drivers who may not have extensive driving experience, comprehensive coverage can offer added peace of mind in unpredictable situations.

- While comprehensive coverage may increase premiums, it can provide valuable protection for new drivers navigating unfamiliar roads and potential risks.

Ultimate Conclusion

As we conclude our discussion on Cheap Full Coverage Insurance Options for New Drivers, it becomes evident that with the right knowledge and approach, new drivers can secure the protection they need at a reasonable cost. Stay informed, stay safe on the road.

Answers to Common Questions

What does full coverage insurance include?

Full coverage insurance typically includes liability, collision, and comprehensive coverage to provide extensive protection for drivers.

How can new drivers reduce insurance expenses?

New drivers can explore discounts offered by insurance companies, maintain a clean driving record, and consider bundling policies to lower overall costs.

What is the significance of comprehensive coverage for new drivers?

Comprehensive coverage is crucial for new drivers as it protects against non-collision incidents like theft, vandalism, or natural disasters.