Cheap Full Coverage Car Insurance for Daily Commuters sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. As commuters navigate the roads daily, finding affordable insurance that offers comprehensive coverage becomes paramount.

This guide delves into key factors, strategies, and comparisons to help daily commuters make informed decisions and potentially save on their car insurance costs.

Factors to consider when looking for cheap full coverage car insurance

When searching for affordable full coverage car insurance, there are several key factors to keep in mind to help you find the best deal. Understanding how these factors influence your insurance rates can ultimately save you money in the long run.

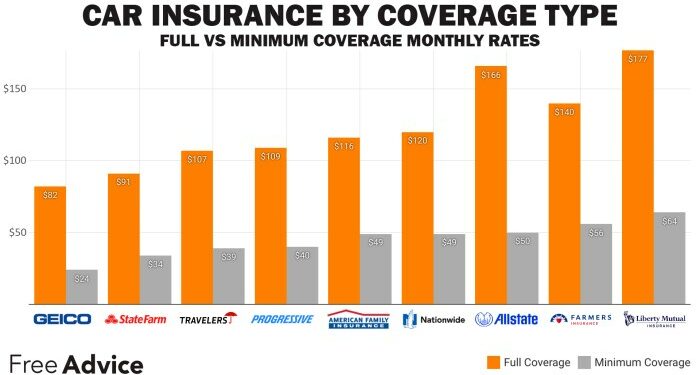

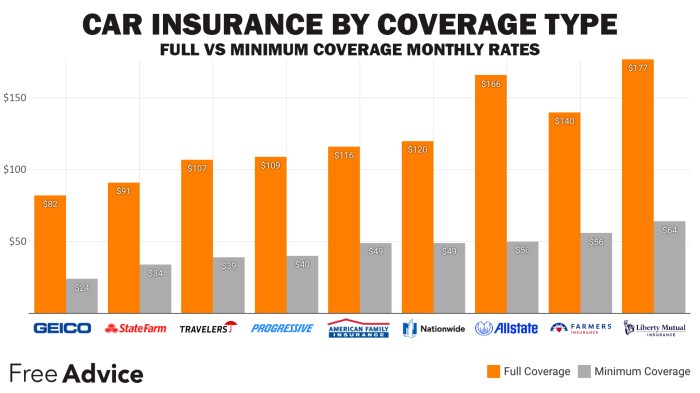

Type of coverage affects the cost

The type of coverage you choose for your car insurance will directly impact the cost of your premiums. Full coverage typically includes liability, comprehensive, and collision coverage, offering the most protection for your vehicle. While this comprehensive coverage can provide peace of mind, it also comes with a higher price tag compared to basic liability coverage.

Driving history and insurance rates

Your driving history plays a significant role in determining your insurance rates. Insurance companies consider factors such as past accidents, traffic violations, and claims history when calculating your premiums. A clean driving record with no accidents or tickets can lead to lower insurance rates, while a history of accidents or violations may result in higher premiums.

Make and model impact insurance premiums

The make and model of your car can also impact your insurance premiums. Cars with high safety ratings and lower repair costs typically have lower insurance rates. On the other hand, expensive luxury vehicles or sports cars may come with higher insurance premiums due to the increased risk of theft or accidents.

When shopping for car insurance, consider the make and model of your vehicle to ensure you get the best rates possible.

Strategies to reduce the cost of full coverage car insurance for daily commuters

When it comes to reducing the cost of full coverage car insurance for daily commuters, there are several strategies that can help you save money and get the coverage you need. From bundling policies to qualifying for discounts based on driving habits, here are some tips to consider:

Bundling Policies to Save Money

One effective way to reduce the cost of full coverage car insurance is by bundling your policies. This means purchasing multiple insurance policies, such as auto and home insurance, from the same provider. Insurance companies often offer discounts to customers who bundle their policies, which can result in significant savings on your premiums.

Qualifying for Discounts Based on Driving Habits

Another strategy to consider is qualifying for discounts based on your driving habits. Many insurance companies now offer telematics programs that track your driving behavior, such as your speed, braking, and mileage. By demonstrating safe driving habits, you may be eligible for discounts on your car insurance premiums.

Additionally, maintaining a clean driving record and taking defensive driving courses can also help you qualify for discounts.

Opting for a Higher Deductible to Lower Premiums

Choosing a higher deductible is another way to lower your full coverage car insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you can lower your premiums because you are taking on more of the financial risk in the event of a claim.

However, it's important to ensure that you can afford to pay the deductible if you need to make a claim.

Comparison between different insurance companies offering cheap full coverage for daily commuters

When looking for cheap full coverage car insurance for daily commuters, it's essential to compare the options provided by various insurers to find the best fit for your needs. Here, we will analyze the coverage options, rates, discounts, and customer reviews of different companies to help you make an informed decision.

Coverage Options Provided by Various Insurers

- Company A offers comprehensive coverage that includes protection against theft, vandalism, and natural disasters.

- Company B provides liability coverage to protect you in case you are at fault in an accident.

- Company C offers roadside assistance and rental car reimbursement as part of their full coverage package.

Rates and Discounts Offered by Different Companies

- Company A provides a safe driver discount for commuters with a clean driving record.

- Company B offers a multi-policy discount if you bundle your car insurance with other policies.

- Company C provides a loyalty discount to long-term customers who renew their policies annually.

Customer Reviews and Satisfaction Ratings

- Company A has received high ratings for their excellent customer service and quick claims processing.

- Company B has positive reviews for their competitive rates and easy online account management.

- Company C is praised for their flexibility in customizing policies to fit individual needs.

Importance of comprehensive coverage for daily commuters

Comprehensive coverage is essential for daily commuters as it offers a wide range of protection against various risks on the road. This type of coverage goes beyond just covering damages from accidents and provides additional peace of mind for drivers facing different situations.

What comprehensive coverage includes

Comprehensive coverage typically includes protection against damages not caused by a collision, such as theft, vandalism, natural disasters, and falling objects. It covers a broad spectrum of incidents that could potentially occur while your vehicle is parked or in motion.

- Protection against theft

- Coverage for fire damage

- Compensation for damage from storms or natural disasters

- Reimbursement for cracked or shattered windshields

How comprehensive coverage protects against risks

Comprehensive coverage provides financial support in situations where your vehicle incurs damages that are not related to a collision. For daily commuters who spend a significant amount of time on the road, this type of coverage can be crucial in safeguarding their investment in their vehicle.

Comprehensive coverage acts as a safety net for daily commuters, offering protection against unforeseen events that could result in costly repairs or replacements.

Examples of situations where comprehensive coverage proves beneficial

- If your parked car gets vandalized while you are at work.

- In case of a break-in that results in theft of personal belongings or damage to the vehicle.

- When your car is damaged by a hailstorm or other natural disaster.

- If a tree limb falls on your car while it is parked.

Final Conclusion

In conclusion, navigating the world of car insurance as a daily commuter can be complex, but with the right knowledge and strategies, securing affordable full coverage becomes more achievable. By understanding the nuances of coverage options, cost-saving strategies, and comparisons between insurance providers, commuters can ensure they are adequately protected on the road without breaking the bank.

FAQ Resource

How does my driving history impact insurance rates?

Your driving history, including any accidents or traffic violations, can significantly affect your insurance rates. A clean driving record often leads to lower premiums.

What is the benefit of bundling policies for insurance savings?

Bundling policies, such as combining car and home insurance, can often lead to discounts from insurance providers, helping you save money overall.

How does opting for a higher deductible lower premiums?

Choosing a higher deductible means you'll pay more out of pocket in the event of a claim, but it can lower your monthly premium amount.

What does comprehensive coverage include?

Comprehensive coverage typically includes protection against theft, vandalism, natural disasters, and other non-collision incidents.

How can driving habits qualify you for insurance discounts?

Insurance companies may offer discounts for safe driving habits, such as avoiding speeding tickets or maintaining a low annual mileage.