Delve into the world of affordable auto insurance tailored for urban and suburban drivers. Uncover the secrets to saving on premiums and maximizing coverage in this detailed exploration.

Explore the nuances of coverage options, factors affecting rates, and strategies to secure the best insurance deals for urban and suburban driving environments.

Factors affecting auto insurance rates for urban and suburban drivers

Location plays a significant role in determining auto insurance rates for drivers, with urban and suburban areas having distinct factors that impact premiums.

Location Impact on Insurance Rates

- Urban areas typically have higher rates due to higher traffic congestion, increased instances of accidents, theft, and vandalism.

- Suburban areas, on the other hand, may have lower rates as they are considered less risky in terms of traffic and crime.

Specific Factors Considered by Insurance Companies

- Population density of the area, as higher density can lead to more accidents and claims.

- Crime rates in the region, with higher crime areas being more prone to theft and vandalism.

- Frequency of accidents in the area, impacting the likelihood of claims and payouts.

- Availability of public transportation, as areas with good transit options can lead to lower individual car usage and fewer accidents.

Differences in Risk Assessment

- Urban drivers are often seen as higher risk due to factors like traffic congestion, higher crime rates, and more accidents.

- Suburban drivers are generally perceived as lower risk, leading to potentially lower premiums compared to urban counterparts.

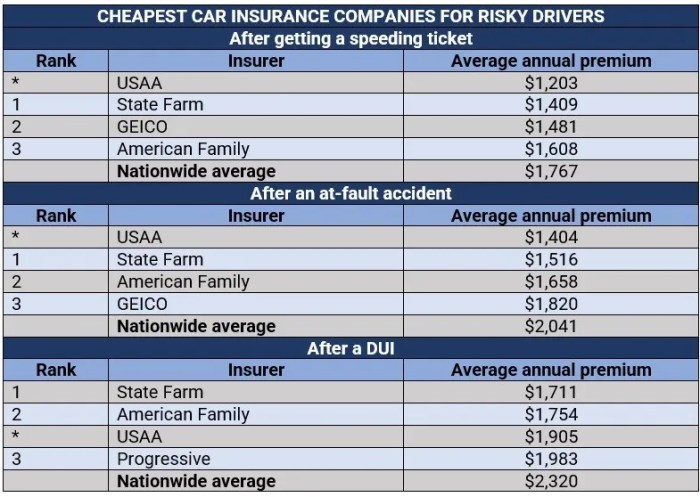

Strategies to find cheap auto insurance for urban and suburban drivers

When it comes to finding affordable auto insurance for urban and suburban drivers, there are several strategies that can help lower insurance costs and ensure cost-effective coverage. By following these tips, drivers can potentially save money while still maintaining the necessary protection on the road.

Comparing Quotes from Different Insurance Providers

- It is essential for urban and suburban drivers to compare quotes from multiple insurance providers to find the most competitive rates.

- By obtaining quotes from different companies, drivers can identify the best offers and coverage options that suit their needs.

- Online comparison tools make it easy to compare quotes quickly and efficiently, helping drivers make informed decisions about their insurance coverage.

Utilizing Discounts and Programs

- Many insurance providers offer discounts and programs specifically designed for urban and suburban drivers.

- Drivers can take advantage of discounts for safe driving records, bundling policies, or participating in defensive driving courses.

- Some insurance companies also offer usage-based insurance programs that monitor driving habits and adjust rates accordingly, potentially leading to lower premiums for responsible drivers.

Differences in coverage options for urban and suburban drivers

When it comes to auto insurance, urban and suburban drivers may have different needs based on their driving environments. Let's explore the variations in coverage options between urban and suburban drivers.

Types of Coverage Options

In general, the coverage options available to both urban and suburban drivers are similar, including liability coverage, collision coverage, comprehensive coverage, personal injury protection, and uninsured/underinsured motorist coverage. However, the extent to which these coverage types are necessary may vary based on the driving environment.

Necessity of Specific Coverage Types

Urban drivers are more likely to encounter higher traffic congestion, greater risk of accidents, vandalism, and theft. Therefore, urban drivers may find comprehensive coverage and personal injury protection more crucial to protect against these risks. On the other hand, suburban drivers may prioritize collision coverage due to higher speeds on highways and rural roads.

Variations in Coverage Needs

The coverage needs of urban drivers differ from suburban drivers primarily due to the frequency and types of risks they face. Urban drivers may benefit from higher liability limits to protect against potential lawsuits resulting from accidents in densely populated areas.

Suburban drivers, on the other hand, may focus more on coverage for damage caused by wildlife or weather-related incidents common in rural areas.

Impact of driving habits and vehicle type on insurance rates

Driving habits and the type of vehicle owned play a significant role in determining auto insurance rates for both urban and suburban drivers. Let's delve into how these factors can influence insurance premiums.

Driving Habits and Insurance Rates

- High mileage and frequent use of a vehicle can lead to higher insurance rates for urban and suburban drivers. Insurance companies consider the increased risk of accidents associated with more time spent on the road.

- Safe driving practices, such as obeying traffic laws, avoiding speeding, and maintaining a clean driving record, can help lower insurance costs for both urban and suburban drivers. Insurance providers often offer discounts for drivers with a history of safe driving.

Vehicle Type and Insurance Premiums

- The type of vehicle owned by urban and suburban drivers can also impact insurance rates. Sports cars or luxury vehicles typically have higher insurance premiums due to the higher cost of repairs or replacements.

- On the other hand, owning a safe and reliable vehicle with advanced safety features can result in lower insurance costs. Vehicles with features like anti-theft systems, airbags, and backup cameras may qualify for discounts.

Last Point

In conclusion, navigating the realm of cheap auto insurance for urban and suburban drivers requires a blend of awareness, strategy, and informed decision-making. By implementing the tips and insights provided throughout this guide, drivers can embark on a journey towards cost-effective coverage without compromising on protection.

Detailed FAQs

What factors impact auto insurance rates for urban and suburban drivers?

Insurance rates are influenced by factors such as location, driving habits, vehicle type, and coverage options.

How can urban and suburban drivers find cheap auto insurance?

Drivers can lower insurance costs by comparing quotes, taking advantage of discounts, and driving safely to reduce risks.

What are the key differences in coverage options for urban and suburban drivers?

Coverage options may vary based on driving environments, with urban drivers often requiring more comprehensive coverage due to higher risks.

How do driving habits and vehicle type affect insurance rates?

Driving habits like mileage and vehicle type play a role in determining insurance premiums, with safe driving practices leading to lower costs.