Delving into the realm of Auto Insurance Quote Trends in the US and Europe unveils a captivating landscape of industry insights. This article aims to explore the nuances and contrasts between these two regions, shedding light on the factors that shape auto insurance quotes.

Auto Insurance Market Overview

The auto insurance industry in the US and Europe plays a significant role in providing financial protection for drivers in case of accidents or damages. While both regions have robust auto insurance markets, there are key differences in how these markets operate.

US Auto Insurance Market

In the US, the auto insurance market is highly competitive, with a wide range of insurance companies offering coverage options to drivers. Some of the major players in the US auto insurance sector include State Farm, GEICO, Progressive, and Allstate.

These companies compete not only on price but also on the quality of service and coverage options they provide to customers.

European Auto Insurance Market

In Europe, the auto insurance market varies by country due to different regulations and market conditions. Countries like the UK, Germany, and France have well-established auto insurance markets with both domestic and international insurance companies operating in the region. Some of the major players in the European auto insurance sector include AXA, Allianz, and Generali.

Key Differences

- The regulatory environment: The US has state-based regulations, leading to variations in insurance requirements and pricing across states. In contrast, Europe has a more standardized regulatory framework.

- Market competition: The US market is known for its high level of competition, driving innovation and competitive pricing. European markets may have fewer players but still offer a diverse range of insurance options.

- Coverage options: Auto insurance policies in the US often include a wide range of coverage options, such as liability, collision, and comprehensive coverage. European policies may vary in terms of coverage and optional add-ons.

Major Players

| US | Europe |

|---|---|

| State Farm | AXA |

| GEICO | Allianz |

| Progressive | Generali |

Factors Influencing Auto Insurance Quotes

When it comes to determining auto insurance quotes, several key factors play a significant role in influencing the premiums that individuals pay for coverage. These factors can vary between the United States and Europe due to differences in regulations, demographics, driving habits, and vehicle types.

Regulations and Insurance Pricing

In the United States, auto insurance regulations are primarily governed at the state level, leading to variations in coverage requirements and pricing from one state to another. On the other hand, European countries often have more centralized regulations that can impact insurance pricing uniformly across regions.

These regulatory differences can result in varying levels of competition among insurance providers, affecting overall pricing strategies.

Demographics and Driving Habits

Demographic factors such as age, gender, marital status, and credit score can heavily influence auto insurance premiums. Younger drivers, male drivers, and individuals with poor credit histories may face higher insurance rates due to perceived higher risk levels. Additionally, driving habits such as mileage driven, frequency of accidents or traffic violations, and where the vehicle is parked overnight can also impact insurance costs.

Vehicle Types and Insurance Premiums

The type of vehicle being insured is another crucial factor in determining insurance premiums. Factors such as the make and model of the car, its age, safety features, and average repair costs all play a role in pricing coverage. High-end luxury vehicles or sports cars may come with higher insurance premiums due to increased repair costs and theft risks, while more affordable and safer vehicles may result in lower insurance rates.

Technology and Innovation

In recent years, technology advancements have significantly impacted auto insurance trends in both the US and Europe. These advancements have led to the emergence of innovative insurance products and services, transforming the way auto insurance is priced and offered to consumers.

Telematics

Telematics, which involves the use of devices to monitor driving behavior, has revolutionized the auto insurance industry. Insurers can now offer usage-based insurance policies, where premiums are based on actual driving habits rather than general demographics. This personalized approach has led to more accurate pricing and reduced premiums for safe drivers.

IoT (Internet of Things)

The Internet of Things (IoT) has enabled insurers to gather data from connected devices in vehicles, such as sensors and cameras. This data can be used to assess risk more accurately and offer proactive services to policyholders. For example, insurers can provide real-time feedback to drivers on their behavior, encouraging safer driving practices.

AI (Artificial Intelligence)

Artificial Intelligence (AI) plays a crucial role in automating processes within the insurance industry. AI algorithms can analyze vast amounts of data to predict risk, detect fraud, and optimize claims processing. This has led to faster response times, improved accuracy, and enhanced customer experiences.

Consumer Behavior and Preferences

Consumer behavior and preferences play a crucial role in shaping the auto insurance market in both the US and Europe. Understanding how consumers approach insurance coverage and their evolving preferences is essential for insurance companies to tailor their products effectively.

Consumer Preferences for Auto Insurance Coverage

Consumer preferences for auto insurance coverage vary based on factors such as risk tolerance, budget constraints, and personal circumstances. While some consumers opt for comprehensive coverage that includes protection against a wide range of risks, others may choose basic coverage to meet legal requirements.

- Some consumers prioritize cost-effective policies with lower premiums, even if it means sacrificing certain coverage options.

- Others prefer more extensive coverage that provides greater financial protection in case of accidents or other unforeseen events.

- There is also a growing trend towards usage-based insurance, where premiums are determined based on individual driving behavior.

Evolution of Consumer Behavior Towards Insurance Purchases

Consumer behavior towards insurance purchases has evolved significantly over the years, influenced by various factors such as technological advancements, changing socio-economic conditions, and shifting regulatory landscapes.

- Consumers are becoming more digitally savvy, preferring to research and purchase insurance online rather than through traditional channels.

- Increased awareness about the importance of insurance coverage has led to a more proactive approach among consumers in securing adequate protection.

- Personalization and customization of insurance products have become key drivers of consumer decision-making, with individuals seeking tailored solutions that meet their specific needs.

Latest Trends in Consumer Demands for Auto Insurance Products

The auto insurance market is witnessing several trends in consumer demands, reflecting changing preferences and priorities among policyholders.

- There is a growing demand for flexible coverage options that allow consumers to adjust their policies based on changing circumstances or usage patterns.

- Consumers are increasingly seeking value-added benefits such as roadside assistance, rental car coverage, and other perks to enhance their overall insurance experience.

- Integration of technology, such as telematics and AI-driven tools, is gaining popularity among consumers looking for innovative ways to monitor their driving habits and reduce insurance costs.

Comparison of Premium Rates

In this section, we will compare average auto insurance premium rates in major cities of the US and Europe, exploring how these rates vary based on factors like age, gender, driving history, and vehicle make/model. We will also discuss any trends or patterns observed in premium rate fluctuations over the past few years.

US vs. Europe Premium Rates

| City | Country | Age Group | Gender | Driving History | Vehicle Make/Model | Premium Rate |

|---|---|---|---|---|---|---|

| New York | US | 25-35 | Male | Clean | Sedan | $1200 |

| London | UK | 25-35 | Female | 1 Accident | Hatchback | £800 |

| Los Angeles | US | 36-50 | Female | Clean | SUV | $1500 |

Factors Influencing Premium Rates

- Age: Younger drivers tend to have higher premium rates due to lack of experience.

- Gender: Historically, males have been charged higher premiums than females.

- Driving History: Accidents and traffic violations can lead to increased rates.

- Vehicle Make/Model: Luxury cars or sports cars often have higher premiums.

Trends in Premium Rate Fluctuations

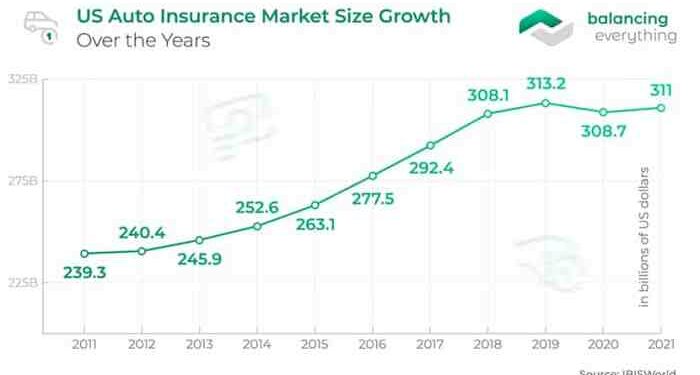

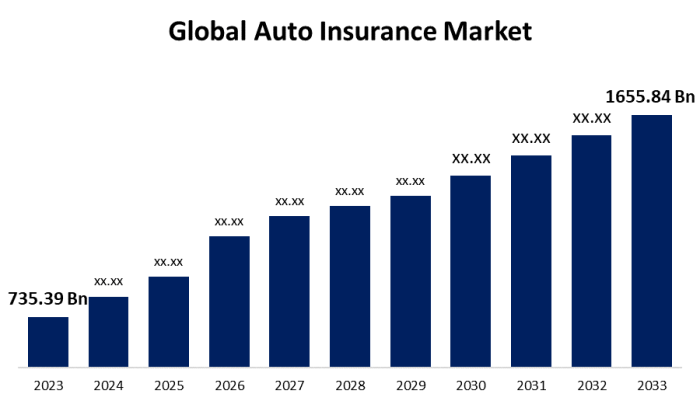

Over the past few years, there has been a general trend of increasing auto insurance premiums across both the US and Europe. This could be attributed to rising repair costs, inflation, and an increase in claims.

Summary

In conclusion, the analysis of Auto Insurance Quote Trends in the US and Europe showcases the dynamic nature of this sector. From technological advancements to consumer behavior shifts, the intricacies of insurance pricing and coverage continue to evolve, shaping the future of auto insurance globally.

FAQ Compilation

What are the primary factors influencing auto insurance quotes?

The primary factors include demographics, driving habits, vehicle types, and regulatory differences between the US and Europe.

How have technological advancements impacted auto insurance trends?

Technological innovations like telematics, IoT, and AI have influenced pricing and coverage, leading to the emergence of innovative insurance products.

What are the major players in the auto insurance sector in the US and Europe?

Some of the major players include Geico, State Farm, Allstate in the US, and companies like AXA, Allianz, and Zurich in Europe.