Auto Insurance Quote Factors Most Drivers Overlook sets the stage for this intriguing narrative, offering readers a peek into a story rich in detail and brimming with originality. From overlooked factors impacting insurance quotes to ways of lowering premiums, this topic delves deep into the nuances of auto insurance pricing.

As we explore the various facets of auto insurance quotes, we uncover the intricacies of factors that often go unnoticed but significantly affect the costs.

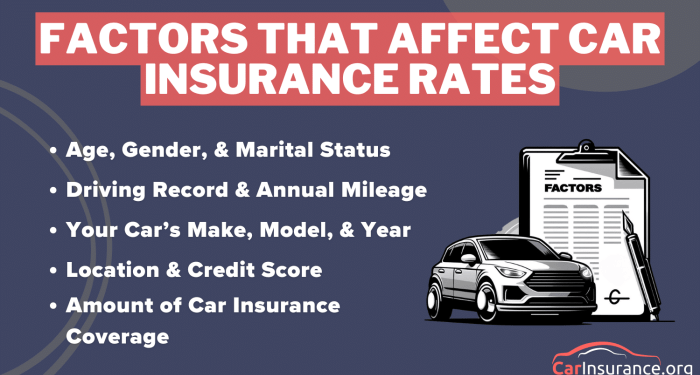

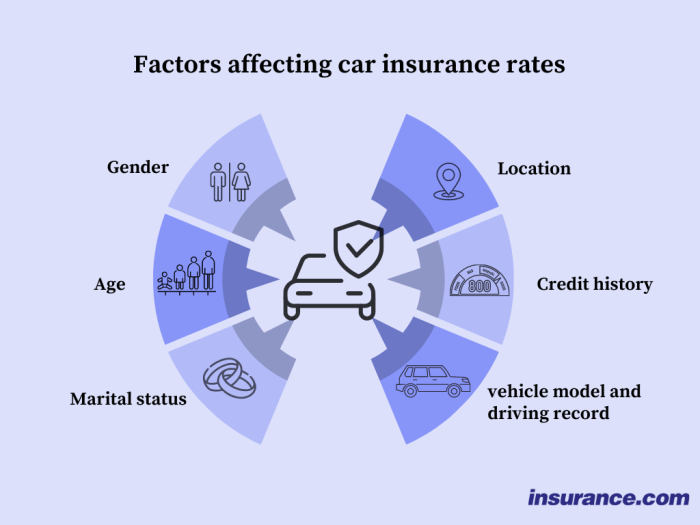

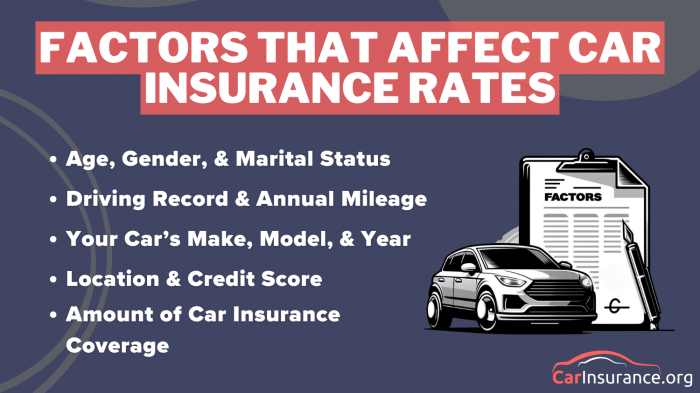

Factors Affecting Auto Insurance Quotes

When it comes to determining auto insurance quotes, several factors are taken into consideration. Understanding these factors can help drivers make informed decisions about their coverage and premiums.

Driving Record

A driver's record is one of the most significant factors influencing auto insurance quotes. A clean driving record with no accidents or traffic violations typically results in lower premiums, as it suggests a lower risk of future claims.

Type of Vehicle

The type of vehicle you drive can also impact your insurance costs. Insurers consider factors such as the make and model of the car, its safety features, and its likelihood of being stolen or involved in accidents when determining premiums.

Location and Local Crime Rates

Your location plays a crucial role in determining auto insurance rates. Areas with higher crime rates or more traffic congestion are typically associated with higher insurance premiums due to an increased risk of accidents or theft.

Age and Gender

Age and gender are also key factors in determining auto insurance rates. Younger drivers, especially teenagers, typically face higher premiums due to their lack of driving experience. Additionally, statistics show that male drivers tend to have more accidents than female drivers, which can impact insurance costs.

Overlooked Factors in Auto Insurance Quotes

When getting auto insurance quotes, many drivers tend to focus on the obvious factors such as driving record, age, and type of vehicle. However, there are several lesser-known factors that can also have a significant impact on insurance premiums.One of these factors is the driver's credit score.

Insurance companies often use credit scores to assess the risk level of a potential policyholder. A higher credit score can lead to lower insurance premiums, as it is believed to reflect a more responsible and reliable individual. On the other hand, a lower credit score may result in higher insurance costs.

Importance of Credit Score in Determining Insurance Premiums

- Insurance companies use credit scores to assess risk levels.

- A higher credit score can lead to lower insurance premiums.

- A lower credit score may result in higher insurance costs.

Impact of Mileage and Usage on Insurance Costs

- Lower mileage and limited usage can result in lower insurance costs.

- Higher mileage and extensive usage may lead to higher premiums.

- Insurance companies consider how often the vehicle is driven and for what purposes.

Previous Insurance Claims History and its Effects on Quotes

- Drivers with a history of frequent insurance claims may face higher premiums.

- Insurance companies view previous claims history as an indicator of future risk.

- Maintaining a clean claims history can help in securing lower insurance rates.

Ways to Lower Auto Insurance Quotes

When it comes to reducing auto insurance premiums, there are several strategies that drivers can utilize to lower their costs. By understanding and taking advantage of various factors that impact insurance rates, drivers can potentially save money while still maintaining adequate coverage.

Comparing Different Deductible Amounts

- Increasing your deductible amount can lower your insurance premium. By opting for a higher deductible, you are essentially agreeing to pay more out of pocket in the event of a claim, which can translate to lower monthly premiums.

- Conversely, choosing a lower deductible will result in higher premiums since the insurance company will be responsible for covering a larger portion of the claim.

- It's important to weigh the potential savings with the increased financial risk of a higher deductible to determine the best option for your individual situation.

Benefits of Bundling Insurance Policies

- Many insurance companies offer discounts for bundling multiple policies, such as auto and home insurance, with the same provider.

- By combining your insurance policies, you can potentially save money on each policy compared to purchasing them separately.

- Additionally, bundling can simplify your insurance management by having all policies with one provider, making it easier to track and manage your coverage.

Leveraging Discounts Offered by Insurance Companies

- Insurance companies often provide various discounts that drivers may qualify for based on factors such as safe driving records, anti-theft devices, and completing defensive driving courses.

- It's essential to inquire about all available discounts with your insurance provider to ensure you are taking advantage of any savings opportunities.

- By actively seeking out and applying for discounts, drivers can potentially lower their insurance premiums without compromising on coverage.

Importance of Regularly Reviewing Auto Insurance Policies

Regularly reviewing your auto insurance policies is crucial to ensure you have adequate coverage and are not overpaying for your premiums. Life changes can significantly impact your insurance needs, and getting multiple quotes can help you find the best deal.

How Life Changes Affect Insurance Needs and Quotes

Life changes such as moving to a new location, buying a new car, getting married, or having children can all impact your auto insurance needs. For example, if you move to a high-crime area, you may need more comprehensive coverage.

Additionally, certain life events can make you eligible for discounts, such as getting married or turning 25 years old.

Benefits of Getting Multiple Quotes Before Renewing a Policy

- Comparing multiple quotes allows you to find the most competitive rates and ensure you are not overpaying for coverage.

- You may discover new discounts or promotions offered by other insurance companies that could help you save money.

- Getting quotes from different insurers can also help you understand the current market rates and make an informed decision about your coverage.

Guide on What to Look for When Reviewing Auto Insurance Coverage

- Check your coverage limits to ensure they still meet your needs and are in line with your state's requirements.

- Review your deductibles and consider adjusting them to lower your premiums if needed.

- Verify that all the vehicles and drivers in your household are accurately listed on the policy.

- Look for any discounts you may be eligible for, such as safe driver discounts or multi-policy discounts.

- Consider adding additional coverage options like roadside assistance or rental car reimbursement if they align with your needs.

Ending Remarks

In conclusion, understanding the factors that most drivers overlook when it comes to auto insurance quotes is crucial in securing the best coverage at the most competitive rates. By shedding light on these hidden influencers, drivers can make more informed decisions and potentially save money in the long run.

FAQ Corner

How does credit score impact auto insurance quotes?

Your credit score can influence your insurance premiums as insurers often use it to assess the risk you pose as a policyholder. A higher credit score can lead to lower insurance rates.

Why is it important to review auto insurance policies regularly?

Regularly reviewing your auto insurance policy ensures that you are adequately covered based on your current needs and circumstances. It also helps in identifying potential savings or better coverage options.

How do life changes affect auto insurance needs and quotes?

Life changes such as moving, getting married, or adding a new driver can impact your auto insurance needs and quotes. It's essential to update your policy to reflect these changes accurately.